Cómo ha evolucionado con el tiempo la ley de garantía extendida de California

California se considera un estado líder en leyes de protección al consumidor. Entre las medidas que ha adoptado a lo largo del tiempo se encuentran regulaciones que cubren los vehículos garantías extendidasExploremos qué significa esto para los propietarios de autos usados de California. En particular, veremos cómo difiere la cobertura de autos de posventa en el Estado Dorado y qué leyes específicas se aplican. Las garantías extendidas se volvieron comunes en California en la década de 1990 y las regulaciones que supervisaban estas ofertas se convirtieron en ley a principios del siglo XXI.

Tenga en cuenta que términos como contrato de servicio del vehículo (VSC), garantía extendida del automóvil y plan de protección del automóvil a menudo se usan indistintamente (como en este artículo). Sin embargo, cuando compra dicha cobertura de terceros en California, se denomina seguro averia mecanica (MBI). Por lo tanto, no se confundan con las diferentes frases.

Repasemos primero algunas definiciones básicas.

Garantías extendidas versus seguro contra averías mecánicas: ¿cuál es la diferencia?

En términos simples, una garantía extendida es un contrato que brinda cobertura después de que vence la garantía de fábrica o la garantía del concesionario de un automóvil. Las garantías extendidas se pueden comprar a través de una empresa externa (como Endurance) o a través del fabricante.

Por lo general, las garantías extendidas adquiridas a través de un fabricante de automóviles tienden a ser más restrictivas en cuanto a antigüedad y kilometraje. Por otro lado, las compañías independientes como Endurance pueden cubrir vehículos que tienen hasta 150,000 millas.

Seguro de avería mecánica (MBI) se vende a través de compañías de seguros y protege sistemas clave como el motor y la transmisión. Además, las pólizas MBI tradicionales generalmente solo están disponibles para autos nuevos. Cabe destacar que MBI no cubre accidentes, robos ni daños al auto. Para obtener esa protección, recurriría a una compañía de seguros tradicional, como Allstate o Geico.

Entraremos en detalles más adelante, pero Endurance ofrece planes MBI híbridos que cumplen con la ley de California pero brindan protecciones adicionales más allá de las pólizas MBI tradicionales.

Vale la pena mencionarlo garantias de autos nuevos, a veces llamada garantía del fabricante, de fábrica o del fabricante del equipo original (OEM). Esta cobertura de garantía protege a los propietarios de vehículos contra defectos de fabricación o de materiales, como si falla la bomba de dirección asistida o si el motor no funciona correctamente.

Periodos de cobertura varían, pero suelen durar entre tres y cinco años (con restricciones de kilometraje). garantía de parachoques a parachoquesMuchos fabricantes de automóviles incluyen un suplemento garantía del tren motriz que puede durar entre dos y cinco años adicionales (también con limitaciones de kilometraje). Sin embargo, esta cobertura adicional no protege muchos otros sistemas que pueden fallar, como la suspensión, la dirección, el control de clima, los frenos y el sistema eléctrico.

Es importante destacar que las garantías de los automóviles nuevos no protegen los componentes (como llantas y Pastillas de freno) que se desgastan con el tiempo o por daños causados por un accidente u otro percance.

Leyes de seguros contra averías mecánicas en California

Leyes que cubren seguro averia mecanica son administrados por la Departamento de Seguros de California (CDI). California exige que todos los vendedores de MBI en el estado tengan licencia y que las pólizas y tarifas de MBI se envíen al CDI para su aprobación. Además, una empresa debe tener un valor de al menos $100 millones (u obtener un seguro complementario) para vender pólizas MBI en el estado. Esto garantiza que una empresa pueda cubrir todas las reclamaciones. A diferencia de otras compañías de garantía extendida, Endurance tiene licencia como compañía de seguros en el estado, lo que le permite ofrecer planes MBI.

A continuación se presentan algunas otras disposiciones clave de la ley de California relacionadas con las políticas de MBI.

Código de Negocios y Profesiones de California, Sección 17500

Este estatuto general prohíbe las prácticas comerciales injustas, engañosas o fraudulentas. Y si bien se puede utilizar contra cualquier empresa que haga negocios en California, el CDI aplica esta ley a las empresas de MBI que pueden hacer promesas excesivas o no ser claras en sus estrategias de marketing, descargos de responsabilidad o divulgaciones de políticas.

Código de Seguros de California, Sección 116.6

Esta parte de la ley define el seguro contra averías mecánicas como un “producto de protección del vehículo”, una clase de seguro que brinda cobertura para reparaciones de garantía del vehículo motorizado. Otras estipulaciones incluso establecen el tamaño de fuente de los documentos de la póliza.

Código de Seguros de California, secciones 1794.41-43

Entre las muchas condiciones de la ley de seguros de California se encuentran los requisitos que:

- Todos los contratos son claros y fáciles de entender. Además, dichos acuerdos deben incluir el nombre y la dirección del vendedor, la duración del período de cobertura y el monto de la franquicia.

- El contrato debe estar disponible para que el consumidor lo revise antes de firmarlo. Se debe enviar una copia del acuerdo ratificado al consumidor dentro de los 60 días a partir del momento de la compra.

- Los consumidores tienen derecho a cancelar la póliza MBI dentro de los 60 días si no realizan reclamos.

Tenga en cuenta que una agencia independiente administra las leyes del limón de California, la Departamento de Asuntos del Consumidor de California.

Leyes de garantía extendida en otros estados

Si bien California tiene las regulaciones más amplias sobre garantías extendidas, otros estados también tienen requisitos específicos. Muchos estados exigen que una empresa de garantías extendidas se registre ante el gobierno y tenga activos suficientes para cubrir cualquier reclamo (a menudo, esto se refuerza mediante una póliza de seguro complementaria que obtiene la empresa).

Además, la mayoría de los estados exigen que las compañías de garantía extendida ofrezcan un período de cancelación (generalmente de 10 a 60 días) con un reembolso total (en algunos casos, se puede deducir una pequeña tarifa administrativa del reembolso). Además, la mayoría de los estados exigen que los contratos detallen las restricciones, como las piezas que no son originales o las usadas.

Aquí hay algunos Aspectos destacados de lo que exigen otros estados.

- Georgia: No existe ninguna disposición que prevea arbitraje. Cualquier disputa debe resolverse mediante el sistema judicial.

- Indiana: define las “garantías extendidas” no como garantías sino como contratos de servicio.

- Kentucky: A menos que una empresa tenga recursos suficientes (entre 1TP y 100 millones o más), debe registrarse en el estado como una compañía de seguros.

- Nevada: Exigir un contrato de servicio como condición para la venta o el préstamo de un vehículo es ilegal.

- Oregón: Los contratos deben estipular si se requiere aprobación previa para reparaciones y detallar el proceso de aprobación.

- Washington: La compra de un contrato de servicio no puede ser una condición para la venta o el préstamo de un automóvil.

Endurance ofrece opciones de MBI en California

Endurance ofrece muchas opciones de seguro contra averías mecánicas para los propietarios de automóviles de California. Todos los planes han pasado el riguroso proceso de aprobación del estado y ofrecen opciones para todos los presupuestos.

Esta es información general; consulte el contrato para conocer los términos, condiciones y exclusiones.

Requisitos para vehículos nuevos y usados

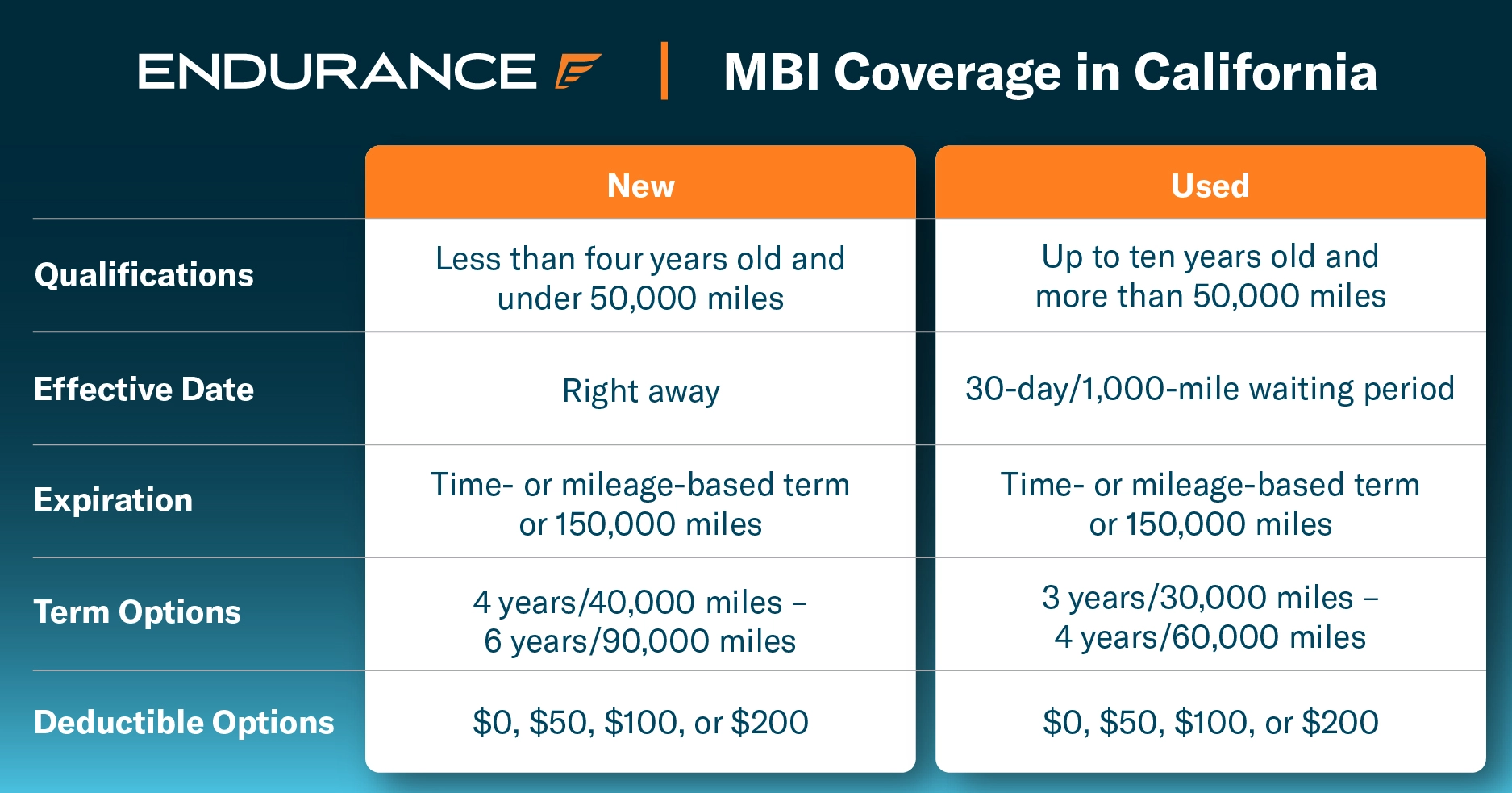

Estos son los requisitos de elegibilidad para la cobertura MBI Endurance en California:

Planes MBI Endurance

Tren motriz plus Es un plan de seguro contra averías mecánicas que cubre los componentes críticos que a menudo son los más costosos de reparar, incluidos:

- Motor

- Turbocompresor/Supercargador (instalado de fábrica únicamente)

- Transmisión

- Transferir caso

- Eje motriz

Estándar del sistema de propulsión Incluye la protección del tren motriz mencionada anteriormente y al mismo tiempo agrega protección para los sistemas que sufren un uso intensivo, como:

- Direccion

- Frenos

- Eléctrico

- Aire acondicionado

- Suspensión delantera y trasera

Tren motriz premium cubre las reparaciones de la mayoría de los sistemas principales incluidos en los planes Plus y Standard, y agrega cobertura adicional:

- Entrega de combustible

- Enfriamiento

- Eléctrico mejorado

- Paquete de lujo

Élite Plus es el plan MBI de cobertura integral definitivo que ofrece Endurance en California. Es un plan excluyente con restricciones mínimas sobre lo que no está cubierto.

Complementos de cobertura de MBI

Cualquiera de estos planes MBI se puede personalizar con cobertura adicional para adaptarse mejor a las necesidades del asegurado:

- Piezas cubiertas Causa de pérdida

- Cobertura de emisiones

- Uso comercial

- Cobertura de quitanieves

- Kit de elevación/neumáticos de gran tamaño

- Reembolsos por remolque/asistencia en carretera, así como por interrupciones de viaje y vehículos de alquiler (durante trabajos de servicio cubiertos)

Conduzca con confianza con Endurance

Los propietarios de automóviles de California pueden conducir con más confianza con un seguro contra averías mecánicas de EnduranceEs la forma más eficaz de prepararse para los problemas con el coche y las facturas inesperadas de reparación. Y es imprescindible cuando vence la garantía de fábrica.

Las pólizas MBI Endurance vienen con planes de pago flexibles y un proceso de reclamo sencillo. La ayuda está a una llamada de distancia con asistencia personalizada del Endurance equipo de atención al cliente. O descargue el Aplicación móvil Endurance para un servicio aún más rápido. Lo mejor de todo es que puedes elegir entre cualquier mecánico certificado por ASE o taller de reparación cuando su vehículo sufre una avería mecánica.

Descubra la tranquilidad que le ofrece una póliza MBI Endurance. Llame al (800) 253-8023 para solicitar un presupuesto gratuito o comprar en línea hoy para sus opciones de cobertura.

Asegúrese de leer el Blog Endurance para artículos útiles sobre mantenimiento de automóviles, reparaciones de bricolaje, revisiones de vehículos y más.

Desde los 16 años, Keith ha estado inmerso en la industria automotriz, comenzando su carrera ayudando a su padre a reparar vehículos a una edad temprana. Keith ahora es dueño de su propio taller de reparación familiar certificado por ASE. A+ Cuidado del automóvilEn su tienda, se centra en construir relaciones de confianza con su comunidad a través de un servicio al cliente excepcional. Leer más Acerca de Keith.