¡Consigue esta oferta! Llama ahora.

Hable con un especialista en planes de protección de vehículos y obtenga $300 apagado cualquier nuevo contrato al instante.

Llamar 866-678-4172

o escanea el código a continuación

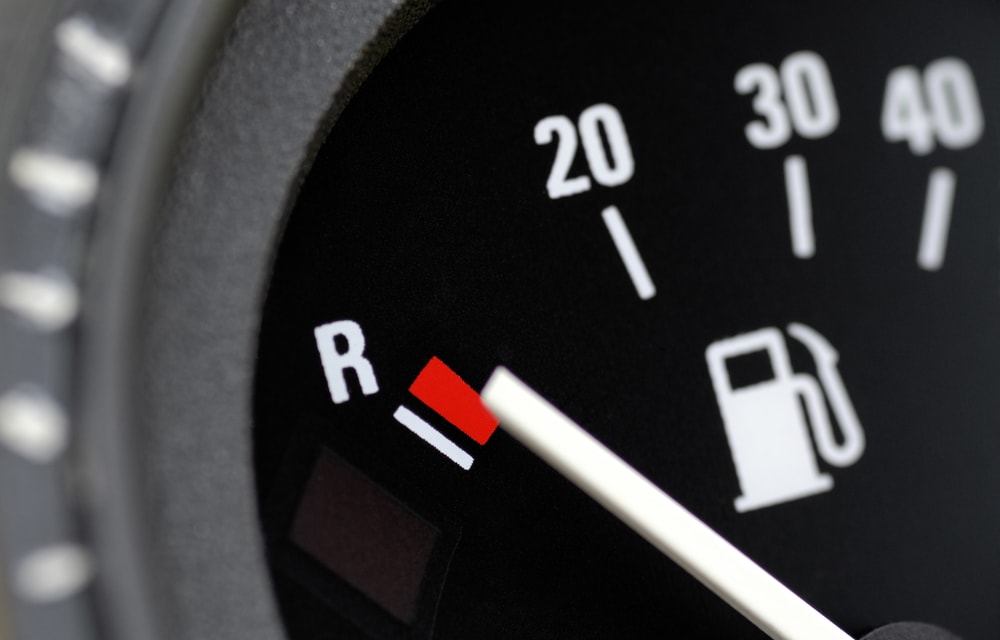

Mientras Los precios de la gasolina han bajado En los últimos años, parece que la demanda de vehículos más eficientes en términos de consumo de combustible está superando la demanda de combustibles fósiles.

En 2017, la demanda de gasolina en Estados Unidos ha sido mucho menor de lo que se había previsto. Si a esto le sumamos una economía en crecimiento y precios de combustible relativamente baratos, la industria energética esperaba una demanda récord, especialmente ahora que se acerca la temporada de conducción de verano.

A principios de enero y febrero de 2017, la demanda de gasolina bajó un 2,1 por ciento respecto del año anterior, según informó la Administración de Información Energética de Estados Unidos. Si nos fijamos en el panorama general, el mercado estadounidense representa alrededor del 10 por ciento del consumo mundial de petróleo. Por lo tanto, los consumidores estadounidenses tienen una de las mayores influencias en el consumo de petróleo. mercado mundial de combustibles fósiles.

Según USA Today, varios analistas relacionan la menor demanda de gasolina con la caída de las ventas de automóviles. Algunos de los analistas informaron que esta disminución de la demanda puede deberse únicamente a muchos factores, como el clima estacional y otros. Sin embargo, las refinerías de petróleo se sienten más pesimistas sobre si la demanda de verano será lo suficientemente fuerte como para impulsar las ganancias por ventas.

En 2016, la demanda de gasolina en Estados Unidos alcanzó un récord de 9,33 millones de barriles por día. Incluso si a mediados de 2017 hubo una caída en la demanda, los kilómetros totales recorridos por los vehículos aumentaron. Esto demuestra que la eficiencia del combustible moderno está en alza.

Muchos analistas y refinadores dijeron a Associated Press que un factor en la caída de la demanda de gasolina fue el clima inusualmente malo en California y Texas, estados con el Los mayores volúmenes de conducción en EE.UU.California experimentó precipitaciones en enero y febrero más del doble de la cantidad del mismo período del año pasado, según un estudio de la Administración Nacional Oceánica y Atmosférica.

Ahora que ha empezado la temporada de conducción de verano, los expertos estarán muy atentos a las ventas y la demanda general de gasolina. El mayor grupo de defensa de los automovilistas de Estados Unidos dijo a AutoBlog que esperan ver conductores en las carreteras estadounidenses a un ritmo nunca visto en una década.

Ese grupo de defensa no es otro que la Asociación Estadounidense del Automóvil. Según sus proyecciones, 34,6 millones de personas recorrerán 80 kilómetros o más desde su residencia durante el período de vacaciones de fin de mes, lo que supone la mayor cantidad desde los 37,3 millones registrados en 2005.

“Soy un poco más optimista sobre la demanda de gasolina en Estados Unidos que hace seis meses”, dijo John Auers de la consultora de refinación Turner, Mason, & Co. “La gente pensaba que 2016 sería un año pico, pero creo que lo superaremos este año”. (AutoBlog)

Mientras tanto, los precios de la gasolina en Estados Unidos han aumentado recientemente, aunque siguen siendo más bajos que en años anteriores. Al momento de escribir este artículo, el precio promedio de la gasolina regular era de $2.34 por galón, lo que es 10 centavos menos que en 2016, según la AAA.

Según un informe del Departamento de Transporte, el total de millas recorridas por vehículos en las carreteras de Estados Unidos aumentó un 1,5 por ciento con respecto al año pasado durante los primeros tres meses de 2017. Esos mismos analistas informaron que los estándares más altos de eficiencia de combustible se han afianzado en la industria, y esto podría conducir a un pico y una meseta en la gasolina estadounidense.

El año pasado, 2016, las ventas de automóviles y camionetas nuevos alcanzaron máximos históricos. Desde 2016 hasta el primer trimestre fiscal de 2017, SUV y camionetas ligeras Según Barclays, los automóviles representaron más del 60 por ciento de las ventas. No fue hasta abril de 2017 cuando las ventas anuales de automóviles cayeron a una tasa anual ajustada estacionalmente de 16,9 millones de automóviles.

Al mismo tiempo, el consumo de combustible promedio de los vehículos nuevos vendidos en Estados Unidos ha aumentado en 0,2 millas por galón desde principios de 2017. Habían alcanzado 25,3 mpg en abril, lo que está cerca del récord del pico de agosto de 2014 de 25,5 mpg según un estudio de Michael Sivak y Brandon Schoettle en el Instituto de Investigación de Transporte de la Universidad de Michigan.

En conclusión, los inventarios de gasolina de EE.UU. se mantienen un 5,8 por ciento por encima del promedio estacional de cinco años.

Estamos aquí para asegurarnos de que obtenga la protección EV más completa. Por eso nos hemos asociado con Xcelerate automático para ofrecerle una cobertura Tesla transparente y confiable.

¿Quiere que nos comuniquemos con usted acerca de la cobertura XCare para su Tesla?

¡Llama y obtén un descuento de $300 en cualquier plan nuevo!

Al hacer clic en el botón, acepta que Endurance utilice tecnología automatizada para llamarlo, enviarle un correo electrónico y enviarle mensajes de texto utilizando la información de contacto anterior, incluido su número de teléfono móvil, si se proporciona, con respecto a la protección del automóvil o, en California, el seguro contra averías mecánicas. También acepta el Endurance política de privacidad y Términos y condiciones. El consentimiento no es una condición de compra y puede retirar el consentimiento en cualquier momento. Se pueden aplicar tarifas por mensajes y datos.

Hable con un especialista en planes de protección de vehículos y obtenga $300 apagado cualquier nuevo contrato al instante.

Llamar 866-678-4172

o escanea el código a continuación

Simplemente complete la información a continuación y le daremos seguimiento rápidamente con su cotización gratuita y sin compromiso.

Al hacer clic en el botón, acepta que Endurance utilice tecnología automatizada para llamarlo, enviarle un correo electrónico y enviarle mensajes de texto utilizando la información de contacto anterior, incluido su número de teléfono móvil, si se proporciona, con respecto a la protección del automóvil o, en California, el seguro contra averías mecánicas. También acepta el Endurance política de privacidad y Términos y condiciones. El consentimiento no es una condición de compra y puede retirar el consentimiento en cualquier momento. Se pueden aplicar tarifas por mensajes y datos.

Para hablar con un especialista en planes de protección de vehículos y guardar $300

Escanee el código a continuación

Alex ha trabajado en la industria de servicios automotrices durante más de 20 años. Luego de graduarse de una de las mejores escuelas técnicas del país, se desempeñó como técnico logrando la certificación de Maestro Técnico. También tiene experiencia como asesor de servicios y gerente de servicios. Leer más sobre alex