FAQ: Why is mechanical breakdown insurance only offered in California?

The state of California offers mechanical breakdown insurance (MBI) as a way to protect consumers from the unexpected costs associated with owning a vehicle. Like an auto protection plan or extended warranty, mechanical breakdown insurance provides coverage for the costs of repairs of mechanical malfunctions that are not covered by the manufacturer’s warranty. For example, if a car’s engine needs to be replaced, it may cost thousands of dollars. However, the repair costs may be covered under an MBI policy, making it an excellent financial security for vehicle owners.

California has stringent car insurance laws in place, which can make it more expensive for residents to purchase traditional auto insurance policies. Mechanical breakdown insurance is meant to provide an affordable option for those who may not be able to afford the expensive coverage offered by conventional auto insurance. Additionally, many repairs typically covered by mechanical breakdown insurance are usually excluded from traditional auto insurance policies.

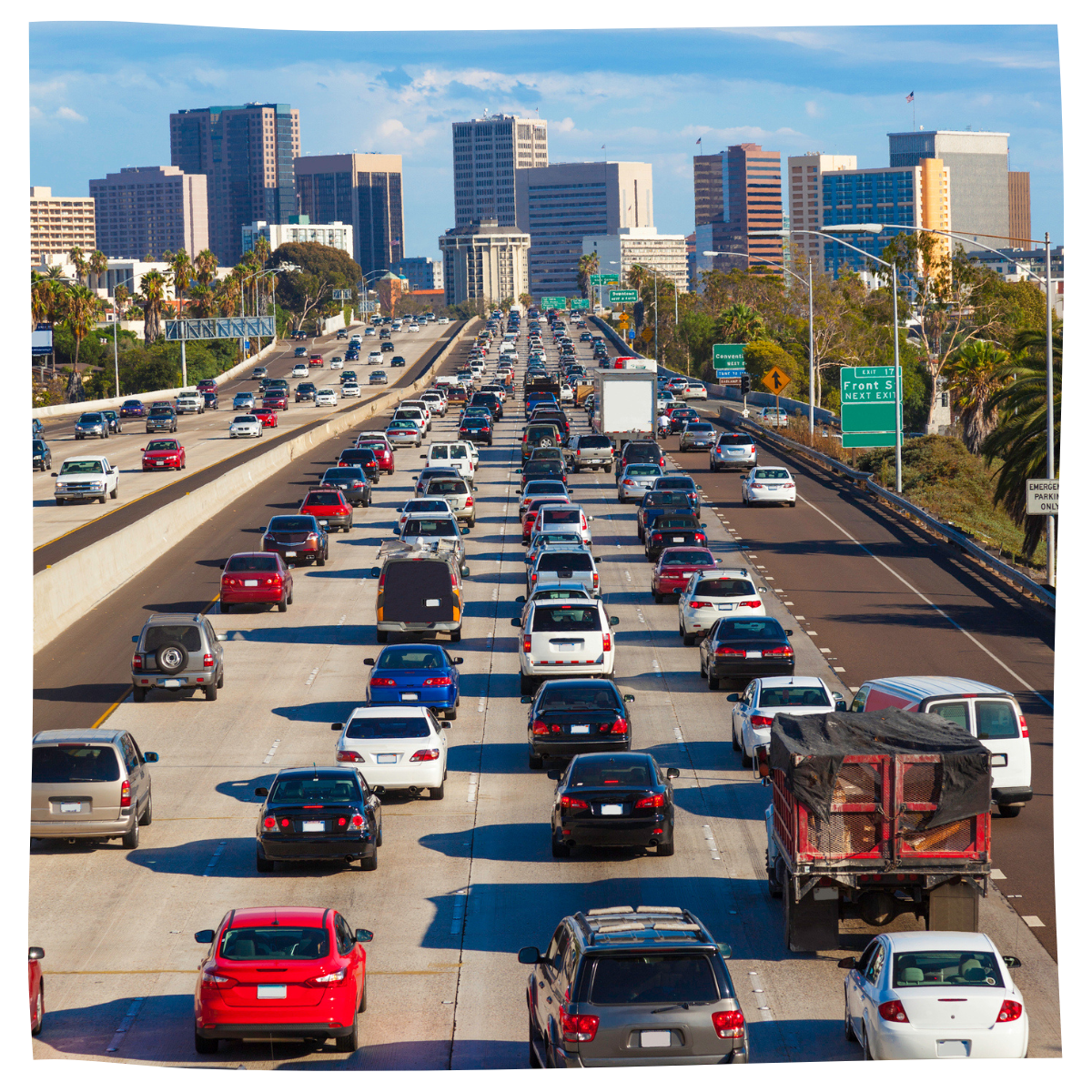

California also offers mechanical breakdown insurance to encourage drivers to maintain their vehicles. Since this type of insurance covers repairs, it encourages drivers to maintain their vehicles to prevent breakdowns and maintain the performance of their cars. This helps to reduce the number of breakdowns that occur due to poor maintenance, which can reduce traffic delays and the number of accidents on the road.

Endurance offers MBI coverage to California residents – with a number of affordable coverage options depending on your vehicle and needs. Call (800) 253-8203 to request a free quote or shop online today.

More FAQs

Driver Benefits

Answers about your coverage, benefits, what sets Endurance apart and whether our plans are covered by insurance.

Filing Claims

Everything you need to know about our easy filing process: when to file a claim, how to file a claim and what happens next.

General Help

Information on the importance of an extended auto warranty and answers about mechanical breakdown insurance.

Getting A Quote

Insights on plan pricing, how to get a free quote, how long your quote will last, what will be covered and where to ask for help.

My Contract

A deeper understanding of your contract including when to use it, how to view it online, and where to go with questions.

Payments

Top answers on how to update billing information, where to see your bill, when your payments are due and where to go with billing questions.